Do you have a rental property or investment property that you would like to sell but don’t want to realize capital gains? Do you also want to maintain ownership in real estate without the responsibility of management?

One of the tools HeimLantz can provide for tax deferment is a 1031 Exchange. Our approach to the exchange utilizes the experts at HeimLantz Wealth Management to create a holistic plan for your investment portfolio.

What is a 1031 Exchange?

A 1031 Exchange allows you to defer capital gains taxes by using the proceeds of a property sale to buy a similar one within a specified amount of time. These are considered like-kind exchanges and can include, but are not limited to, the types of properties listed below:

- Commercial properties

- Single-family or multi-family rental properties

- Land

- Vacation homes

- Tenant-in-common interests

What are the benefits of 1031 Exchange?

Ultimately, tax deferment is the primary driver of the exchange process, but there may be other strategic considerations for facilitating a 1031 Exchange.

The following are some of the benefits to consider:

- Retain ownership in real estate without the hassle of property management

- Generate income

- Property type change

- Investment location change

- Portfolio diversification

- Active versus passive management

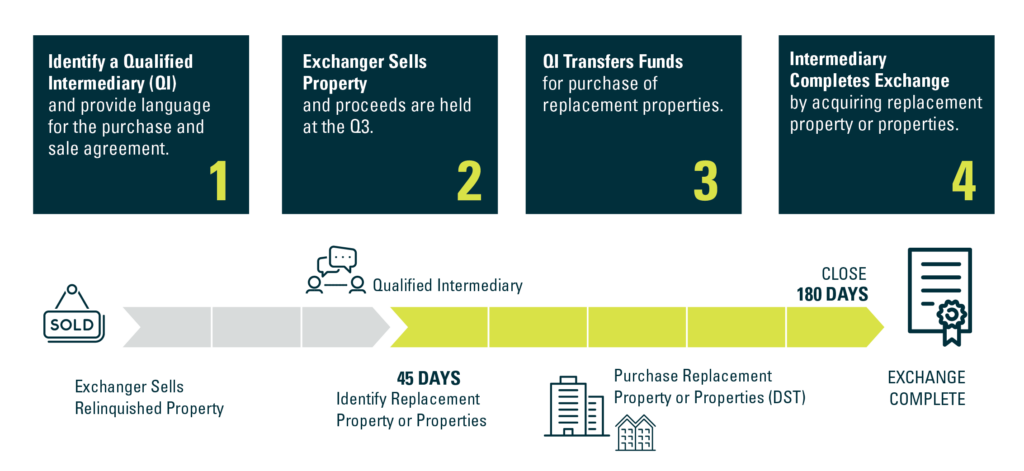

What is the timeline of a 1031 Exchange?

How do I start the process?

The first step is contacting a trusted advisor from the HeimLantz team. We can take you through a more detailed conversation regarding the process and the properties available at the time of your exchange.

Is there more than one type of 1031 Exchange?

Yes. Executing a 1031 Exchange requires strategic planning to find the right timing and the right property that makes sense for you. Working with an experienced advisor can offer opportunities beyond a traditional exchange that you may not have considered.

For example, a 1031 DST allows you to enter into a Delaware Statutory Trust that provides fractional interest in a property with multiple owners.

This is just one of the types of strategic alternatives we like to provide our clients at HeimLantz.

What are the drawbacks of a DST 1031 Exchange?

- 1031 DST investors give up control. With a 1031 DST, you give up that control and let a national institutional property manager do all of the landlord duties.

- The 1031 DST properties are illiquid

- Cost, fees, and charges

- You must be an accredited investor

- You cannot raise new capital in a 1031 DST

- Small offering size

- DSTs must adhere to strict prohibitions

This website is neither an offer to sell nor a solicitation of an offer to buy any security which can be made only by a prospectus, or offering memorandum, which has been filed or registered with appropriate state and federal regulatory agencies and sold only by broker dealers and registered investment advisors authorized to do so.

Additionally, we cannot offer any of our open offerings unless we have a pre-existing relationship with a customer. Once we have obtained sufficient information to perform an evaluation of our new customers’ financial circumstances and sophistication in determining his or her status as an accredited investor, we would be able to discuss future offerings once they become available.